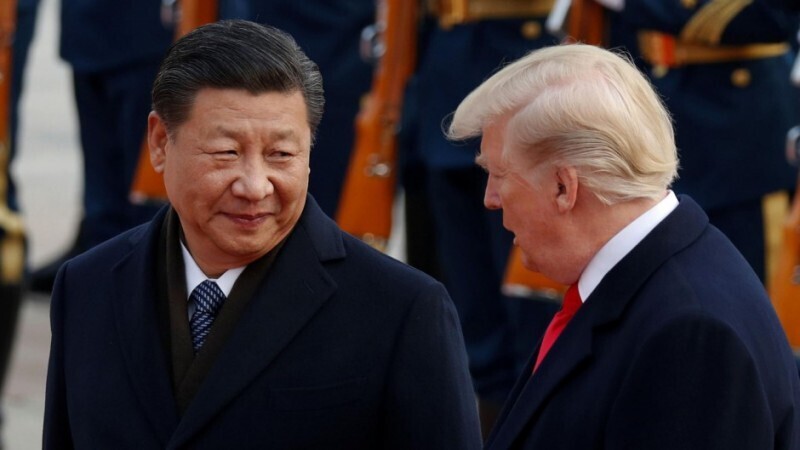

There is no real urgency to resolve issues with Mexico because trade continues to function and costs are relatively low. While Washington closes fronts with other powers and pauses dialogue with Mexico, attention shifts to the 2026 review of the USMCA. Despite the confidence that economic officials show in public, the delay is concerning because more than 15% of Mexican exports to the US remain subject to tariffs. Trump and Xi Jinping meet in South Korea and agree to a reduction in tariffs. The announcement between Trump and Xi, analysts agree, does not substantially change the scenario for Mexico, although it does set the tone for the US strategy. However, it is noted that the negotiation with Mexico has its own schedule: the formal review of the USMCA is scheduled for 2026. For Casillas, moreover, this delay is part of his negotiation style: 'Trump has used tariff threats to achieve non-commercial goals.' While Mexico awaits definitions from Washington on the application of tariffs on the eve of the USMCA review, the trade agreement between the United States and China opened a new stage in US trade policy and highlighted the lag in negotiations with Mexico. Following his meeting with Xi Jinping in South Korea, Donald Trump announced a reduction in tariffs on Chinese products from 57% to 47% in exchange for Beijing resuming US soybean purchases and strengthening controls on fentanyl trade. 'There is no real urgency to resolve with Mexico because trade continues to work and costs are relatively low.' The net impact could even be positive for Mexico, but we must watch if the truce prolongs,' warns Rodolfo Ostolaza, Deputy Director of Economic Studies. Gabriel Casillas, chief economist at Barclays, considers this move 'provides information for Mexico to do the same,' by observing how Washington redefines its tariff policy. 'Everyone is clear except us,' a source from the Ministry of Economy confesses to LPO, pointing out that Washington has already reached understandings with China, the European Union, the United Kingdom, and Taiwan, but not with Mexico. What is at stake is the position of strength with which it arrives at the USMCA review,' he maintains. Trump uses tariffs as a bargaining chip. In the short term, the agreement could ease global logistical pressures and indirectly benefit Mexican supply chains, although it may also slow the pace of relocation from Asia. Trump uses tariffs as a bargaining chip. The US also questions the subsidies to Pemex and the restrictions in the electricity sector, which it considers preferential treatment. Mexico, for its part, denounces unilateral tariffs on steel, aluminum, and tomatoes, as well as barriers to exporting livestock and agricultural products. 'If it takes a little longer, it gives him room to exercise that power,' he explains. Janeth Quiroz, director of analysis at Monex, agrees that the new understanding with China does not substantially change the bilateral relationship. This is because, according to her, the trade tensions between the two powers (which began during Trump's first term and continued during the Biden administration) will remain, although the new agreement will partially reduce them. According to the Monex analyst, the biggest challenge is not in the current tariffs, but in the lack of political definitions. By then, analysts warn, the Mexican government will have to have resolved the US complaints about a lack of competition in strategic sectors and greater openness in energy and telecommunications, especially after the disappearance of bodies such as the Federal Economic Competition Commission (Cofece) and the Federal Telecommunications Institute (IFT).