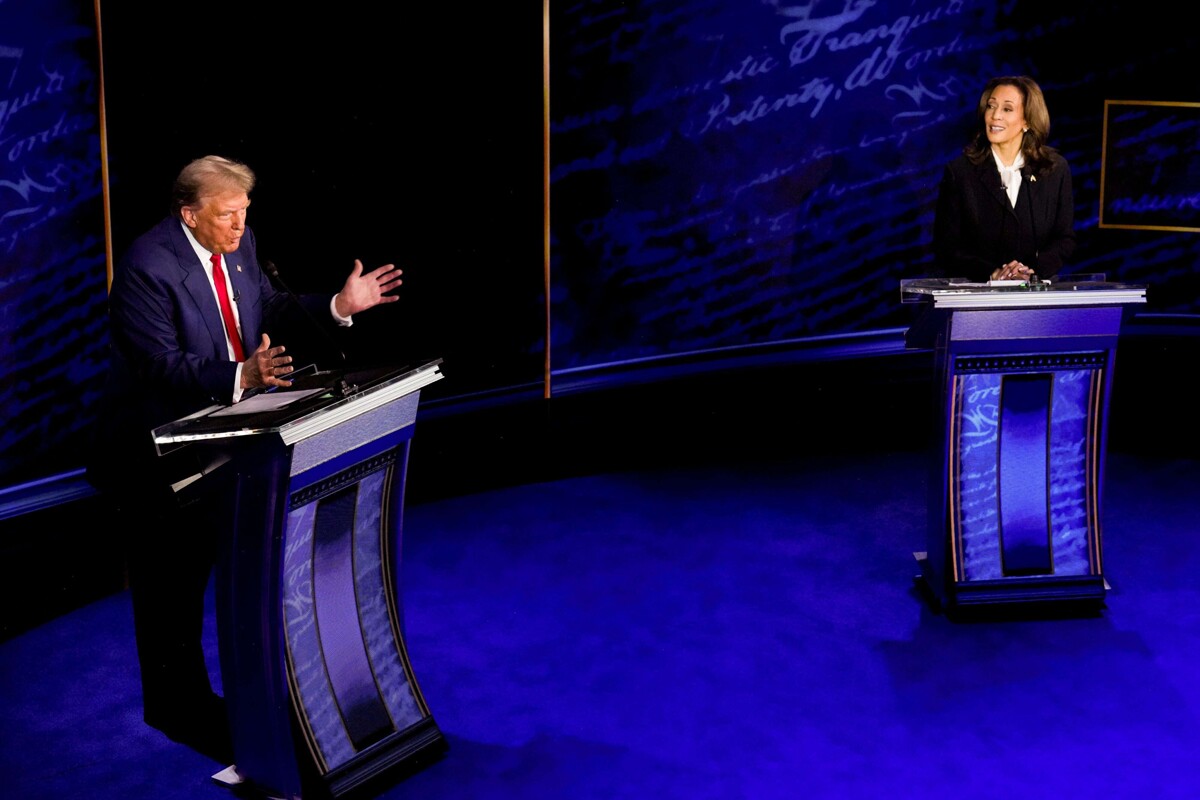

The 2024 autumn annual meetings of the International Monetary Fund (IMF) and the World Bank (WB) concluded over the weekend in Washington. Investors and analysts are increasingly anxious about the outcome of the presidential elections in the United States on November 5. Although most polls show a tight race between Donald Trump and Vice President Kamala Harris, financial markets are preparing for a possible return of Trump to the White House, supported by trends in betting sites and electoral prediction platforms.

During the meetings, the update of the IMF's WEO report was discussed, forecasting stable but modest global growth for 2024 and 2025, with potential risks such as wars and trade protectionism. The importance of global cooperation to address challenges such as climate change and transformations in the world, such as the digitization of money and artificial intelligence, was emphasized.

Gabriel Casillas, chief economist for Latin America at Barclays, shared that the most recurring theme among investors at the meetings was the outcome of the elections in the United States. According to Casillas, the majority of investors in Washington consider Trump's victory likely, which has been reflected in financial markets with the strengthening of the dollar and the weakening of the Mexican peso.

Casillas proposed several possible scenarios after the elections. One of them is that the result may not be known immediately and uncertainty may prolong, which could generate volatility in financial markets. Another scenario is that Trump questions the legitimacy of the results in the event of a close defeat, which could trigger social discontent and violence.

In summary, uncertainty in financial markets related to the elections in the United States is high due to the various possible scenarios that could unfold depending on the electoral outcomes.